With President Obama's first State of the Union Address tomorrow, Americans should take a look at the real state of our republic by listening to someone whom we know is speaking from a position of principle and true understanding.

With President Obama's first State of the Union Address tomorrow, Americans should take a look at the real state of our republic by listening to someone whom we know is speaking from a position of principle and true understanding.Neither Obama, nor the establishment leadership, nor the mainstream media anticipated or warned us of the housing bust, the credit crunch, or the recession- so their credibility is lacking and their appraisal of the state of our union should be suspect.

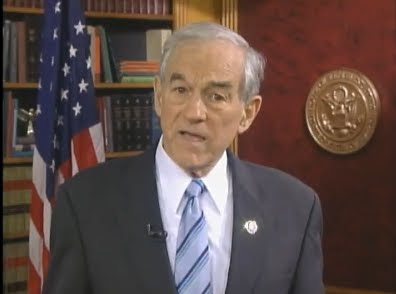

But Congressman Ron Paul and his economic adviser, Peter Schiff did predict all three. Let's see what their understanding of the state of the union is. As you watch, note how specific and technical Dr. Paul's speech is. Remember that when you hear the vague platitudes and impotent pandering in Obama's State of the Union Address tomorrow.

(Hat tip: Young Americans for Liberty)